There’s a problem young, future-oriented companies face when attempting to bring easy-to-understand, trustworthy financial services to the public.

They want to make people’s lives easier. They want their customers to have a smooth experience. They might even wear t-shirts instead of suits.

But the second they mention that they work in the financial services industry, this is what people imagine:

It can be hard to break free from this perception of financial institutions, and as a result, it can be tough to find new customers.

It doesn’t matter how reliable your services are or how innovative and customer-oriented your processes are – your business will stall unless you can communicate these benefits to the public.

Creating a brand is the first step in that process, and this article guides you on how to get started.

What Is Fintech Branding?

Fintech branding is the process of creating a strong, positive image in the minds of the public when it comes to the company’s services and reputation. It aims to express the company’s identity by combining design, logo, mission statement, and consistent messaging across all Fintech marketing channels.

The best Fintech branding, in essence, is the process of separating your company from the competition – mainly traditional banks – in the public’s mind. It is part of your overall marketing strategy, and it is the art of communicating the benefits of your services to build trust, which is necessary for potential customers to become customers.

Branding might be an intangible process that can be undervalued by certain companies, but it is a process more, and more customers are becoming attuned to. That’s why a study found that 87% of customers believe consistent marketing across all platforms is essential.

But why should that be the case?

Well, let’s take a moment to think things through.

Let’s say a potential customer is making their first foray into the area of financial technology. They don’t know anything about the industry; they don’t know anything about its leading companies.

So who can they trust? Especially in the financial services industry, where making the wrong choice can have dire repercussions for their financial future?

That’s where branding comes into the picture. Because customers know how the big brands market themselves. They’ve seen the Adidas commercials, and they’ve come across Nike on their social media pages.

Because of branding, customers instinctively know how the best companies go about their business.

So the odds are they’ll pick a Fintech company whose branding reminds them of other big companies they trust.

That is why Fintech companies need to adopt a good Fintech brand strategy. It goes beyond just the logo – the company’s entire presence online and in traditional media must be consistent to draw in new customers and win their trust.

Why Is Fintech Branding So Important?

Branding might sound like a word marketers invented to have something to do.

It isn’t.

Fintech branding is a powerful tool that has the power to make or break a company. Even newly-minted Fintech startups, strapped for cash and looking to spend their capital developing their products, shouldn’t hesitate to assign a sizeable portion of their resources to develop their brand.

Here’s why:

| Reason | Explanation |

| Communication |

|

| Brand awareness |

|

| Financing |

|

Now, these statistics might not be taken from studies of the financial sector, but don’t let that fool you – they might be even more relevant to the financial sector than other industries.

Why?

Take this statistic as an example: 73% of Americans say that finance is the number one stress in their life.

How might they respond to a company that helps alleviate that stress? How might a financial company perform if it can position itself in the minds of the public as the brand that will help them in that regard?

In one word: well.

And research backs us up. Brands with a strong identity outperform the competition by 25%.

But for many Fintech startups, the question remains – what should we focus most of our energies on? Product development? Legal frameworks? AI and machine learning?

All these options seem like they might produce far more tangible benefits to the company than branding… right?

But the thing is that none of these tools matter if your target customers don’t know and trust your brain, and that’s the reason why 83% of executive business leaders believe in the power of brands to deliver the bottom line.

P.S. If you’d like to learn more about the impact of a brand on businesses outside of a strictly Fintech perspective, check out Growth Gurus’ podcast on Why You Should Love Your Brand.

How To Build a Fintech Brand

The brand-building process for Fintech companies

Even if a brand can be an intangible, hard-to-quantify asset, the process of creating one isn’t.

Here are the eight steps designed to achieve the best Fintech branding:

- Brand strategy workshop

- Brand name

- Logo

- Guidelines

- Story

- Assets

- Website

- Launch

But this is merely the appetiser. Now let’s dive into the main course.

1. Brand strategy workshop

An effective branding strategy is something that affects every part of your business. It’s something that has to affect every part of your business.

And it is during a brand strategy workshop that the best Fintech brand strategy can be developed.

A brand strategy workshop is a perfect decision for startups looking to define their core ideas. The workshop should aim to answer two questions:

- Who are you as a company?

- What are your customer’s problems?

Based on the answers to these two questions, companies should cut to the heart of their brand’s DNA and define these components.

| Component | Feature |

| Brand purpose |

|

| Vision |

|

| Values |

|

| Target audience |

|

| Competitor research |

|

| Awareness tactics |

|

| Personality |

|

| Voice |

|

| Tagline |

|

| Brand design |

|

Once a company has decided about its brand’s components, it has effectively laid the groundwork for the brand, allowing it to move to the next step in the process.

This is where we start at Growth Gurus – we assist you in laying a solid foundation for your brand strategy with our Brand Identity DNA Workshop.

2. Brand name

The reason why companies need a good brand name is simple – customers want names that are memorable, simple, and descriptive.

But finding a good brand name is no joke. In fact, it might require a session of deep, deep meditation.

But while you’re soul-searching, it might be useful to know some parameters that might help you narrow your options.

Here are some of the parameters to keep in mind:

- Distinctive: Something memorable, a name that will lodge itself in the back of the customer’s mind

- Accessible: Easy to understand, easy to spell, and easy to Google

- Available: A name with an available web domain and trademark

- Evergreen: A name that can grow with your company, not a name that’s tied to modern slang and will be obsolete tomorrow

- Visual: A name that can be communicated through your logo, design, etc.

3. Logo

When designing and selecting a brand logo, a company must pay careful attention to their choice – after all, it’s one of the most important elements of any brand.

75% of customers recognise a brand by its logo. And 50% of customers are likely to patronise a brand if they recognise the logo.

Sounds like an awful lot of incentive for companies to design the best Fintech logos.

But how do you get it done? Collaborating with a marketing agency might be one way to go. Since your logo is often the first image customers will come to associate with your brand, the process of designing it cannot be something a company does on the fly.

What companies need is someone who’s done it before. Someone with experience of what works and what doesn’t, to ensure you’re not merely guessing.

As it happens, we have quite a bit of experience creating logos that people can’t help but remember. So if you’re looking for help, we’re right here!

4. Guidelines

Brand guidelines are often also referred to as the brand style guide.

They are meant to inform every part of the look and feel of a brand’s design, while also dictating the content of its marketing, website, social media, and so on.

By making the design and tone of the messaging consistent across all platforms, the brand becomes easily recognisable. Customers begin associating the brand with a certain colour palette and specific ways of communicating with the public.

A colour palette like this one ensures that the design team has specific guidelines to follow when designing any part of the marketing campaign.

You have to remember – 90% of consumers expect consistent branding across all platforms, but only 10% of brands deliver on this demand.

5. Story

A brand story takes all the details and facts about a company and weaves them together into a cohesive narrative that represents the company’s vision and purpose. Its purpose is to elicit an emotional reaction and create a connection between the customer and the brand.

But this might all sound like a collection of intangibles again, right?

So let’s get down to brass tacks.

A good brand story sounds something like that of Warby Parker. One of the two founders once spent a semester without his glasses because he lost them and couldn’t afford a replacement. So he helped create a brand that offers affordable glasses.

More than that, for every pair of glasses a customer buys, another pair is donated to one of the 2.5 billion people who don’t have access to eyewear.

Now that’s a story. But what are its consequences?

According to research, if people love a brand story, 55% are more likely to buy the product in the future, 44% will share the story, and 15% will buy the product immediately.

6. Assets

Brand assets are elements of a brand that are instantly recognisable to the customer. It might be the colour scheme, it might be the font of the brand name or the song that is associated with it.

It’s important to note that these elements only become brand assets when the customers recognise them. The font is just a font until Ryan Gosling obsesses over it on SNL – then it becomes an asset.

7. Website

When it comes to website branding, the first question to answer is: What is the website’s goal? As a Fintech brand, are you aiming to educate prospective customers on your services or do you plan to demonstrate your values?

You have to design a website with your target audience in mind and provide them with the content they are most likely to find meaningful.

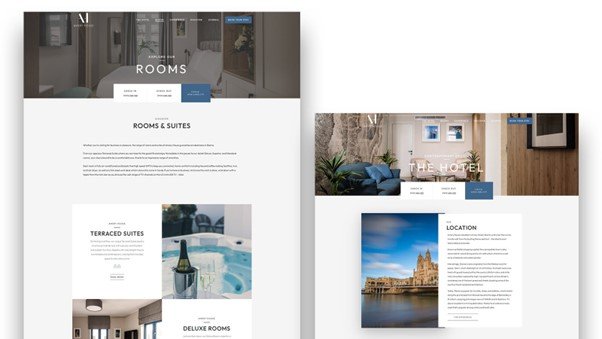

Then your website must be consistent in its design as it might be considered the basis of all other design endeavours. You can take Amery House as an example of a company with a website that has a consistent design, whether the customer visits it on their desktop or their mobile device. This is a perfect example of providing a good user experience.

8. Launch

A brand launch is essentially broadcasting the brand message and making a good first impression.

It is a company’s golden opportunity to position itself correctly in the market, draw in its target audience, and communicate its vision and principles to the public.

Given the importance of a brand launch, it’s no surprise it’s a juggling act where the company’s future is on the line.

A brand launch must be executed according to a specific timeline, coordinating multiple channels to communicate with the public about what is coming. Those channels include:

- Social media

- Traditional media

A good brand launch is always done internally first.

One reason is that your stakeholders and employees must have a thorough grasp of what the brand stands for and what they can expect from it in order to deliver on customer expectations.

Another reason is that your employees are essentially the first people to come into contact with the brand; therefore you can use this opportunity to identify potential issues.

Once your internal team is on board, you can introduce your brand to the world, often through a live event that includes some of the key players in your industry.

Fintech branding tips and guidance

Always start with a workshop

There are many reasons why a workshop is a crucial part of every brand’s foundation.

The biggest is the unique opportunity it offers stakeholders to have their voices heard.

You don’t want employees or management to have doubts about certain aspects of the brand’s identity – they will never work hard for a brand they do not believe in.

Your brand should tell a story and not be a sales pitch

As mentioned above with Warby Parker, the story is far more powerful than the sales pitch.

To say you are attempting to turn a profit is fair, but it is not particularly attractive to consumers.

To say you are trying to solve a problem, on the other hand, a problem you have experienced yourself? That gives your brand an entirely different look.

By focusing on the sales pitch, you come to be seen as just another organisation that fulfils a certain demand in the market.

But by focusing on the story, you come to represent certain principles and ideas. Which is what draws people in – and builds loyalty.

Recycle assets to be as cost-effective as possible

Whether we are talking about content, design, or anything else that directly impacts your brand – recycle what you can.

Branding isn’t a cheap endeavour. The expenses can pile up between all the designers, marketers, and copywriters.

So to try to keep costs reasonable, re-use whatever you can, whenever you can.

Think long-term

Forget short-term planning. It becomes obsolete too quickly.

Long-term branding is the option companies must focus on. Why? Well, for one, research finds that consistent brand representation increases companies’ revenue by 23%.

Better yet, 48% of consumers expect the brands they follow to consistently present them with new information.

That means companies should ensure content marketing is a big part of their branding strategy.

We’re talking about:

- Newsletters

- Blogging

- Podcasts

- Videos

Get outside help

Branding might seem like it requires nothing more than a good logo and a good catchphrase. And though both could be called very important, it’s the context of the broader branding strategy that determines their value.

A marketing agency like Growth Gurus is one of many examples of companies with years’ worth of experience helping companies develop their brands and we have the client reviews to prove it.

Through a partnership with a marketing agency, companies can stop guessing what might work and what won’t, recognising that their branding efforts are too important to be left to chance.

Two Examples of the Best Fintech Branding

FinXP

FinXP is a Fintech company operating in Europe and processing millions of euros in payments each day.

Formerly known as Paymentworld Europe Ltd., the company approached us looking to rebrand and reposition themselves in the mind of their customers.

So we helped rename the brand, designed a new logo and brand identity, and completely redesigned the website. To launch the rebrand, we created a video to familiarise the brand’s new look with the company’s customers.

The result?

Klarna

Klarna is a Swedish Fintech company that offers its customers the chance to buy products online without making the full payment at check-out. Instead, shoppers can spread their payments over four interest-free instalments that are automatically charged every two weeks.

Shoppers can also take advantage of Klarna’s credit options which can span up to 36 months.

It was around 2017 that Klarna’s branding changed. They adopted the “Pay in 4” motto and adjusted their design, leaving behind the boring look of a bank, and fearlessly adopted bright colours and the “Smooth” campaign that aimed to show the smoothness of their customer experience by naming Snoop Dogg as the spokesperson.

Snoop Dogg even temporarily changed his name to Smooth Dogg.

Now that’s smooth.

Fintech Branding FAQs

How do you brand a Fintech?

Branding a Fintech requires following a specific process outlined above that helps companies define their identity, their look, and how they mean to communicate their vision and their values to the public.

The process begins with a brand strategy workshop and continues into the development of the logo, the brand name, the brand style guide, the story, and more.

Can you give me more examples of great Fintech branding?

In case you missed it, you can examine our two favourite branding examples above.

But in case you want to check out a few more examples of the best Fintech branding, here’s a quick look at three more:

- Wise.com: The company is an international money transferring service that has positioned itself brilliantly to separate itself from its traditional competitors.

- Coinbase: The company is a digital currency wallet and platform. Its platform welcomes its customers to “the future of money.”

- Zopa: The British Fintech company offers its customers deposits and credit cards that launched a successful campaign called “The FeelGood Money Company.”

Beyond branding, what are other successful Fintech marketing tactics?

While branding should always be first and foremost on the list of any company’s priorities, some tactics can play a fundamental supporting role in the larger picture of your Fintech marketing strategy.

Here are three of our favourites:

- Gamification: These tactics help turn boring parts of various processes interesting, driving overall user engagement and providing an opportunity for customers to share their experiences with their friends. Companies can use games to give out rewards and prizes and most often use this tactic before brand or product launches to generate interest.

- Influencer marketing: A very effective tactic for gaining direct access to the consumers, it involves connecting with third-party influencers and incentivising them to promote the company’s services or products.

- Experiential marketing: Refers to engaging with the customers in the real world by providing them with an experience that aims to connect the consumer with the brand.

Launching a New Fintech Brand?

If your foray into branding is just beginning, then this might be the time for you to take a closer look at brand strategy workshops to drill down to the core of your company’s vision and identity.

So with that in mind, check out our “Brand DNA Workshop template” to smoothly take your first step into the world of Fintech branding.

And if you’d like some more guidance, also take a look at our article on How To Run A Marketing Strategy Workshop The Right Way as a companion resource.

Love it or hate it, branding is a process no company can afford to ignore. But instead of experimenting on your own, hoping you get it exactly right, you could also try the alternative: enlisting the help of an expert partner.

Interested in learning what that might look like? Schedule a free discovery call where we’ll take you by the hand and explain everything you need to know!